Next-Gen GST Reforms in Agriculture: The Farmer’s Perspective

The Goods and Services Tax (GST) Council has recently announced New GST reforms for various key sectors in the Indian economy. One of the key sectors is agriculture, which holds a significant role in Indian Economy. These GST reforms will improve the lives of the farmers. To understand every detail about the GST reforms in agriculture, keep on reading this blog till the end.

Table of Contents

- The Next-Gen GST Reforms for Better Lives of Farmers

- GST Reforms 2025 Slab System of Agriculture

- Promoting Agri-Mechanization for the Farmers and The Road Ahead

The Next-Gen GST Reforms for Better Lives of Farmers

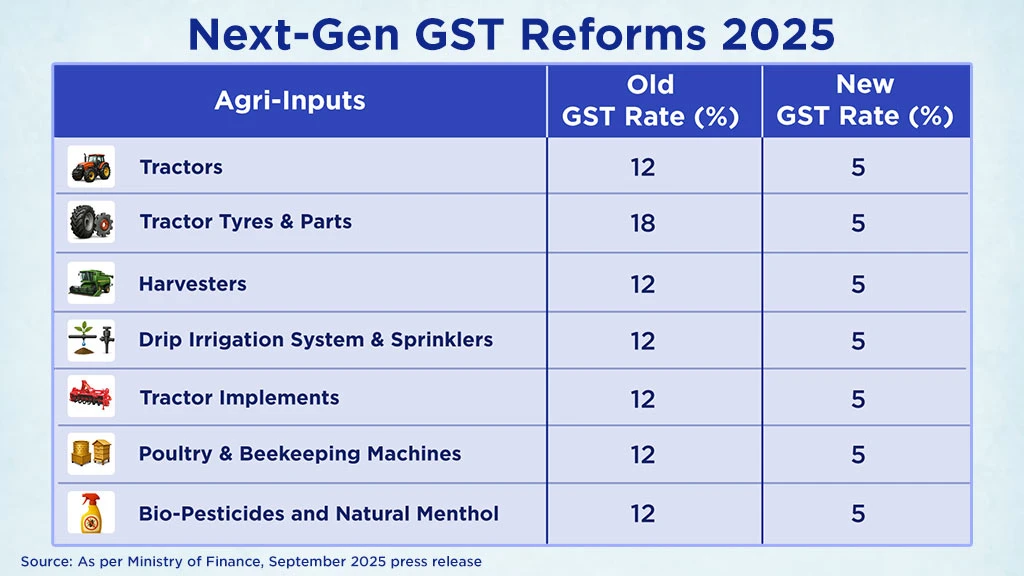

Farmers in India require various agricultural inputs for efficient farming such as tractors, farm implements, fertilizers, etc. Earlier, GST rates on tractors and other farm inputs were higher which made them expensive for farmers. To provide relief to all the farmers, the Next-Gen GST reforms were introduced in September 2025 by the Government of India.

On 22nd September 2025, these reforms came into action reshaping India’s taxation system to serve the needs of farmers better. These GST reforms mark a significant simplification of the GST structure. These reforms strengthen India’s vision of inclusive growth, sustainability, and empowerment of the next generation farmers.

GST Reforms 2025 Slab System of Agriculture

Tractors, Implements, sprinklers, fertilizers, etc. are some of the farming inputs that come under the new GST reforms slab system. Let’s have a look at all the items with the new GST taxes:

Promoting Agri-Mechanization for the Farmers and The Road Ahead

The New GST Reforms 2025 has a significant effect on agricultural inputs like tractors and farm machinery. With the reduced GST taxes, farmers can now buy farm machinery at cheaper prices. They can now invest more and make their farm output more efficient, hence improve their income. With the Government support, cheaper machinery and lower GST rates will help farmers reduce costs and encourage sustainable farming practices. If you are planning to buy agricultural equipment and want any information about tractors and other farm equipment, then Tractorkarvan is the leading platform for obtaining necessary details. On Tractorkarvan, you can find details on all brands tractors, tractor implements, farm tyres, harvesters, etc. with complete specifications and features.

The new GST reforms of 2025 have added a new chapter to India’s tax journey. It helps in the inclusive prosperity and economic transformation of the country. Effective from 22nd September 2025, the reforms reaffirm India’s commitment to building a simpler, fairer, and growth-oriented GST framework, ensuring ease of living for farmers.

Related Blogs