Basics of Mutual Fund: Types, Benefits & How to Invest

Today's world seems more interested in investing for savings and achieving financial goals. Young generation can benefit from early investing, as compounding helps build a large corpus of wealth in the long term. However, with limited financial knowledge, it becomes difficult to start the investment journey. Considering this, in this blog, we will cover one of the most important financial investment instruments: mutual funds. We will start with the fundamentals of mutual funds and answer all your doubts and questions in simple terms.

Table of Contents

- What is a Mutual Fund?

- How Do Mutual Funds Work?

- Benefits of Investing in Mutual Funds

- Types of Mutual Funds

- How to Invest in Mutual Funds?

What is Mutual Fund?

Mutual funds are a convenient investment option in which money from multiple investors is pooled and invested in diversified assets, such as stocks and other securities. The pooled money is invested and managed by professional fund managers. Mutual funds are becoming popular among investors because of their various benefits, including the ability for investors to start investing with any amount, which can be as low as Rs. 500. They allow diversification across multiple stocks, stress-free investments without needing a demat account, and the option to automate your SIPs.

Mutual fund investment options are popular, as investments are made under the supervision of qualified fund managers who make investment decisions after conducting market research and analysis, which lowers the risk involved. However, market volatility can never be ignored.

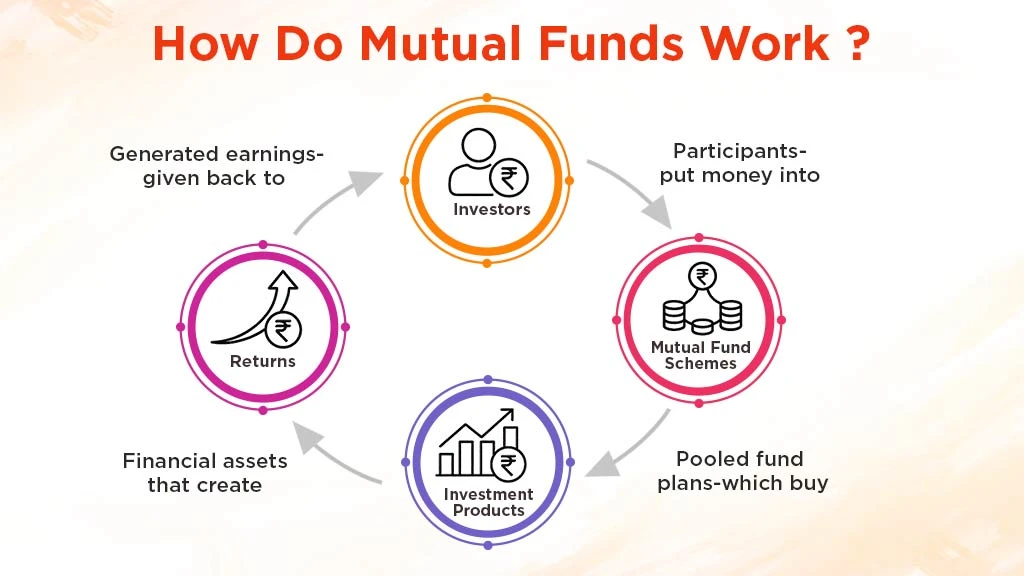

How Do Mutual Funds Work?

Mutual funds primarily operate by collecting funds from investors and then investing in a mix of assets and securities. The collection of funds and pooled money is managed and handled by a team of professionals who have expertise in fund management. This entire process is carried out under an Asset Management Company (AMC), which is responsible for creating, managing, and operating the mutual fund.

This team of professionals is led by the fund manager, who oversees the portfolio and decides where and how to invest the fund capital. These investments are made based on the fund strategy and in-depth research and analysis of the market trends.

Once the fund is invested, in return, you will get mutual fund units, which represent your share of the total fund. The value of these units is determined by the NAV (Net Asset Value), which reflects the per-unit value of the fund’s total assets after subtracting its liabilities. As the NAV increases, the value of your investment goes up, and that’s how you earn.

Mutual funds are mainly of two types based on their fund management style: Actively Managed and Passively Managed. In actively managed funds, fund managers conduct analysis and research to select stocks and invest the money to maximize returns, while the goal of fund managers in passive mutual funds is to replicate the performance of a specific market index.

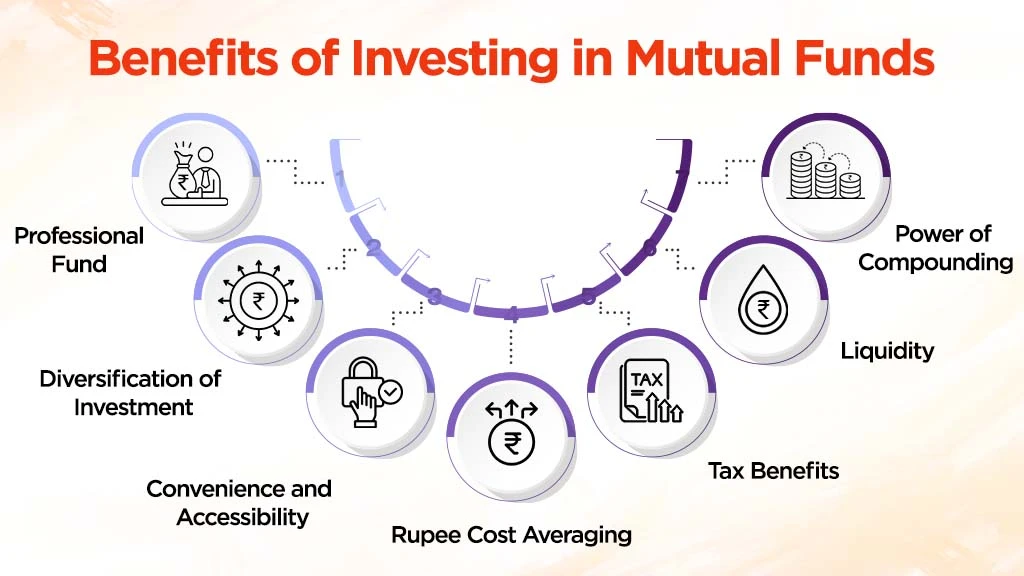

Benefits of Investing in Mutual Funds

Mutual funds offer a smart and structured way to build wealth, making them suitable for both beginners and seasoned investors. With professional management, a wide range of schemes, and flexible investment options, they cater to different financial goals and risk profiles.

Professional Fund Management

One of the most significant advantages of learning about mutual funds is that they allow beginners to enter the market. They enable you to invest your money while investment decisions, stock analysis, and research are handled by experienced fund managers who monitor trends and strategize investments to maximise returns.

Diversification of Investment

One can spread their investment across different assets, such as equities, bonds, and money market instruments. The diversification of investments reduces overall risk, as the better performance of other assets can offset the poor performance of a single security.

Power of Compounding

You can take advantage of the power of compounding, where returns begin generating additional returns over time. The longer you stay invested, the more your wealth can grow exponentially. Even small, consistent contributions can accumulate into a substantial corpus when allowed to compound over several years, making mutual funds ideal for long-term financial goals.

Convenience and Accessibility

Mutual fund investing is very convenient, as one can invest and monitor their investment using mobile applications or online platforms. It also eliminates the need for a middleman, making the entire process paperless and saving significant time and effort.

Rupee Cost Averaging

You don't need substantial funds to start investing in mutual funds. A Systematic Investment Plan (SIP) allows you to begin with small, consistent contributions. This method uses Rupee Cost Averaging (RCA), which is an investment strategy in which a fixed amount is invested by you at regular intervals, irrespective of market price fluctuations. It enables you to buy more units when prices are low and fewer when they are high. Essentially, it averages investment costs over time, thereby reducing the impact of market fluctuations.

Tax Benefits

ELSS schemes are considered one of the most attractive schemes for tax-saving options as they allow investors to have deductions on investments up to Rs. 1.5 lakhs, as outlined in Section 80C (Income Tax Act 1961). The scheme also features the shortest lock-in period of 3 years among all tax-saving instruments. It provides greater flexibility than other such options. Additionally, these funds help investors enjoy favourable long-term capital gains tax treatment by allowing investors to keep a larger portion of their returns while building wealth efficiently.

Liquidity

Mutual funds offer high liquidity, allowing you to sell your units whenever you need funds. Unlike fixed deposits or real estate, your investments can be easily liquidated in an emergency without lengthy procedures. Most open-ended mutual funds credit the redeemed amount directly into your bank account within a few working days, ensuring quick access to money.

Types of Mutual Funds

Mutual funds are of various types based on different parameters. Below, we have mentioned the types of mutual funds based on the asset class.

Equity Mutual Funds

A kind of investment scheme in which primarily investment is made in stocks of publicly listed companies, to generate long-term capital appreciation.

Investments in equity mutual funds bring high risk with high returns, where the investments are primarily made in the stocks of companies. This kind of fund is suitable for investors seeking long-term capital growth. The best things about equity funds are that they allow ordinary investors to utilize the same wealth creation opportunities as large institutional players without requiring individual effort in selecting and picking the stocks.

Once you understand what equity mutual funds are, let's now move ahead to find the answer to the question: why do such funds matter?

Equity Mutual Funds matter because they provide you the opportunity to own quality companies without picking the stocks yourself. Also, they provide professional fund management and diversification, aiming to achieve higher returns and reduced risk.

Based on market capitalization, equity funds are divided into three types:

- Large-Cap Funds: These funds target the top 100 companies listed on the stock exchange. (based on market capitalization)

- Mid-Cap Funds: Those companies ranked from 101 to 250 on the stock exchange fall under this category.

- Small-Cap Funds: This includes companies beyond rank 250 based on their market capitalization.

In conclusion, as a beginner, you should understand that equity funds can outperform other investments over time, but they involve certain risks because they are directly market-linked.

Debt Mutual Funds

In debt funds, investments are made in fixed-income instruments, such as government bonds, debentures, and corporate deposits, making them less risky and generally offering stable but lower returns compared to equity funds.

Debt mutual funds are a kind of loan-based instrument in which, after investment, you earn interest in return, basically lending money to governments, banks, or companies. These kinds of funds matter because of the stability they provide; one can have predictable returns, volatility is lower, and investors enjoy better liquidity than traditional FDs. Coming to its working, this fund operates with the help of fund managers who select the mix of bonds, and these bonds earn interest regularly, where the fund's Net Asset Value changes based on interest rate movement, the credit quality of issued bonds, and demand-supply.

Below are a few of the debt fund types:

- Liquid Funds

- Corporate Bond Funds

- Short Duration Funds

- Gilt Funds

In conclusion, you should understand that debt funds are an ideal choice for beginners, mostly because they involve low to moderate risk.

Hybrid Mutual Funds

Investments in this kind of fund are made in both equity and debt instruments managed in a single portfolio, which balances risk and return, offering moderate growth with lower risk than pure equity funds. The fund is basically designed to benefit in both ways by bringing higher return potential and by providing the safety of debt. In this fund, the fund manager decides how much to invest in equity, debt, and other assets like gold. This ratio will be decided with the objective of balance in mind.

There are various types of hybrid mutual funds, such as:

- Conservative Hybrid Fund: Best for bringing steady returns

- Balanced Hybrid Fund: Balanced return

- Aggressive Hybrid Funds: Ideal for long-term wealth creation

In essence, these funds matter as they are best for risk control, which they manage by adopting the strategy of diversification. They provide better stability in comparison to equity funds and are best at bringing better returns than pure debt funds.

Commodity Mutual Funds

These funds allow investments in physical commodities such as gold, silver, or other resources, either directly or through commodity-related companies. The advantage that such a fund brings is that you do not need to invest in physical commodities; instead, you benefit from rising commodity prices without actually holding them physically. There are several types of commodity funds; below are a few mentioned:

- Gold Mutual Fund

- Multi-Commodity Fund

- Commodity-Linked Equity Fund

- International Commodity Fund

People choose to invest in these funds because they help in gaining a hedge against inflation. They are also useful as they are more suited to portfolio diversification and provide easy exposure without handling storage. Overall, you can consider commodity mutual funds if you are looking for inflation protection or seeking portfolio diversification beyond stocks and bonds.

How to Invest in Mutual Funds?

After understanding the different types, let us now move ahead and take a look at the path you need to follow for investing in mutual funds.

- Assess Your Financial Goals

Financial goals are important to determine, as they help you find the right mutual fund that can help you achieve your desired goals. For instance, one might invest with the objective of capital appreciation; for them, equity funds are preferred, as they offer higher returns with greater risk. Similarly, investors with different objectives can choose the funds that align with their goals. Also, you need to determine your risk appetite, which is again an important factor that helps in deciding on the fund you should invest in.

- Understand the Types of Mutual Funds

You can now finalize the mutual fund based on your goals and risk appetite: equity, debt, hybrid, etc. For example, if you are comfortable with higher risk and higher returns, an equity fund might suit; if you want less risk, a debt fund may be better.

- Choose the Investment Portal

You can choose to invest with an AMC or via a distributor. When you select Direct plans, you often pay lower costs, while distributors may charge a fee, but they benefit you in making the process easier by guiding you through fund selection and providing personalized advice.

- Make the Purchase

When making the purchase, you can choose either a Systematic Investment Plan (SIP) or a lump sum payment.

-

- SIP: investing a fixed amount regularly (monthly/quarterly) helps in maintaining financial discipline

- Lump sum: a larger amount of investment in one go, which may be suitable if you have surplus funds.

To learn more about SIP vs Lump Sum Investment, read SIP vs Lump Sum Investment: Which Strategy Works Best for You?

- Invest and Monitor Your Investment

Once you are done investing, you must track your portfolio periodically to monitor your fund's performance, changes to your fund, and your goal progress. Monitoring is just not about checking the NAV every day, but it means staying aware of the market conditions and any sudden changes. Sometimes you might need to rebalance your portfolio in order to meet your desired goals and objectives, so to do all this, you need to patiently and consistently monitor your investments.

Mutual funds are one of the most popular financial instruments because they help you save time and effort, as most of the research and administrative tasks are handled by the asset management company. You just need to choose a suitable plan and start investing.

Frequently Asked Questions On Basics of Mutual Fund

1. What is mutual fund?

A mutual fund is an investment vehicle that allows investors to invest their money in a diversified portfolio of stocks, bonds, and other securities.

2. Are mutual fund investments guaranteed?

No, mutual funds are subject to market risk and do not guarantee returns or protect the principal.

3. What are the types of mutual funds?

The three main types of mutual funds based on asset classes are equity, debt, and hybrid (a mix of both).

4. Can I redeem my mutual fund investment anytime?

In most open-ended schemes, you can redeem your units on any business day at the applicable NAV.

5. What is NAV in a mutual fund?

NAV (Net Asset Value) is the per-unit market value of the mutual fund’s assets minus liabilities, used for buying or redeeming units.

6. Do mutual funds offer tax benefits?

Yes, some funds (like ELSS in India) offer tax deductions under Section 80C, subject to a lock-in period.

Related Blogs