SIP vs Lump Sum Investment: Which Strategy Works Best for You?

SIP (Systematic Investment Plans) and lumpsum investments are two popular investment methods that can help grow wealth. Both these methods have their own benefits and drawbacks, which majorly depend on factors like risk tolerance, individual financial goals, current market conditions, etc. This article will discuss the difference between SIP and lump sum investing to decide which is better SIP or lump sum based on your personal needs and financial requirements.

Table of Contents

- What is SIP?

- What are the Key Benefits of SIP?

- What is Lump Sum Investment?

- Key Benefits of Lump Sum Investment

- SIP vs Lump Sum: Key Differences

- Why Choose SIP?

- Why Choose Lump Sum?

What is SIP?

Systematic Investment Plan (SIP) is a way of investing in mutual funds that can be started with a small amount of money, that are usually paid in monthly investments. SIP can be started with a fixed amount for a set time period, making it a smart and regular investment option for salaried individuals.

Rupee cost averaging strategy in SIP reduces the impact of market volatility. Over time, with compounding, the returns generated on the invested amount are reinvested, and this helps in building wealth. Below, we have discussed this in detail.

Daily and monthly SIP can be compared to choose the frequency of investment that suits an individual. SIP returns are calculated using the Extended Internal Rate of Return (XIRR) method to help plan long-term financial goals like retirement. SIP payments can also be changed or paused if needed due to any financial reasons.

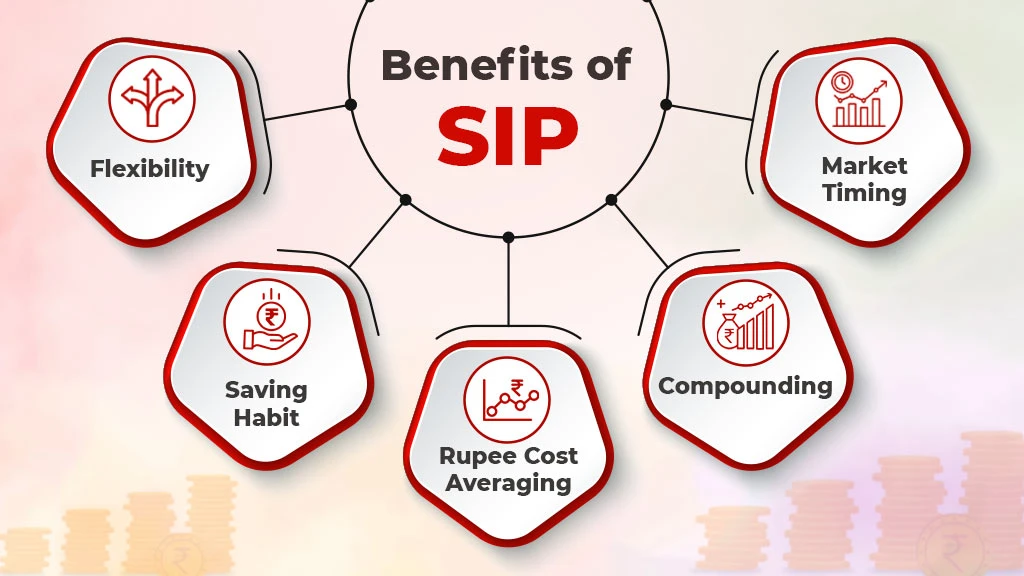

What are the Key Benefits of SIP?

Flexibility

The amount of investment can be increased or decreased as per the individual's income. Investors can also pause their SIPs during financial crisis and then then restart later when market conditions become better.

Saving Habit

Investing a set amount of money helps develop a savings habit. Each month, setting aside a fixed amount can help build financial discipline and bring long-term success for the investor.

Rupee Cost Averaging

It is one of the primary benefits of SIP as it allows an investor to buy more units when the market is down and fewer when it’s up. This flexibility helps average out the cost of investment over time and reduces the impact of market volatility

Compounding

Returns from your previous investments compound over time, and this helps you gain more wealth in the long run. Regular investment in a SIP allows each new contribution and its generated returns to earn further returns.

Market Timing

For SIP investment, there is no need to worry about choosing the ‘perfect’ time to invest in the market. Since it is usually a long-term investment, it averages out over time. If someone chooses to invest when the market is low, then they can buy more mutual fund units at lower prices and get greater returns in the future.

What is Lump Sum Investment?

In a lump sum investment, a large amount of money is put into a mutual fund at once. This type of investment is best suited for people who have surplus capital with them and want to invest it immediately. The full investment amount is put in the market, which increases the potential risks, but it could also give higher returns if the market is going up at that time.

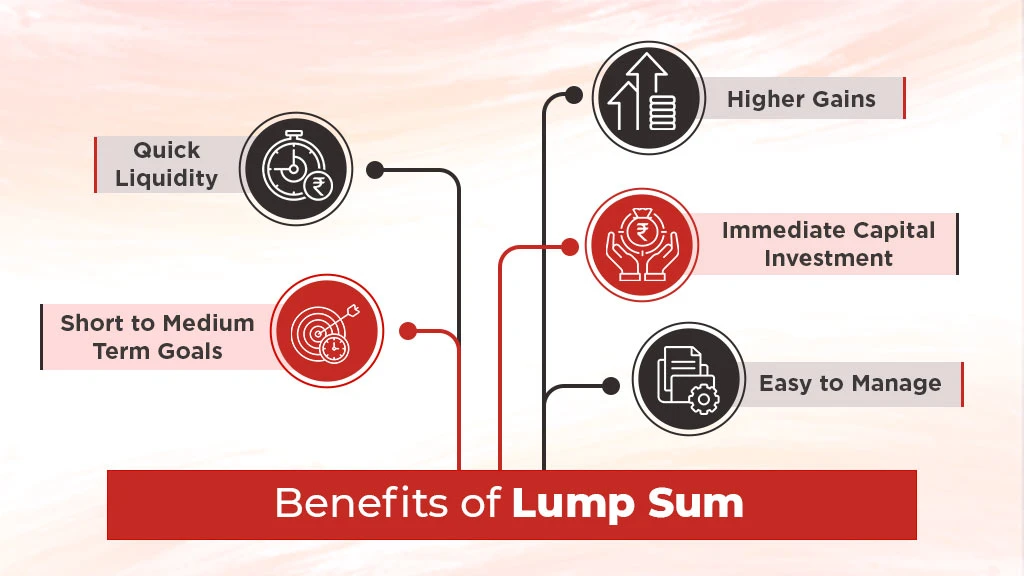

Key Benefits of Lump Sum Investment

Higher Gains

A lumpsum investment can give better returns if it is invested at a time when the market is low and it starts growing after the investment. But if the market situation takes time to improve, then the investor might have to wait to get some profits on the invested amount.

Immediate Capital Investment

Investors can use their extra capital at once by investing it in the market when it is bearish, as it opens a window of accelerated growth. Since the entire amount is invested altogether, the investment starts earning returns from day one without any delays.

Easy to Manage

Once the single payment is done, there is no need to keep track of any other payments. A lump sum investment can give a strong initial boost to the portfolio and also make it easy to manage.

Quick Liquidity

There are fewer transactions to track in lump sum investments, which makes it simple to track. Also, the immediate liquidity offered here makes it easy to exit from lump sum investments.

Short to Medium Term Goals

Lump sum investments get immediate market exposure and potentially higher returns if timed well. This method can help attain short to medium-term goals, but it needs greater tolerance for risk.

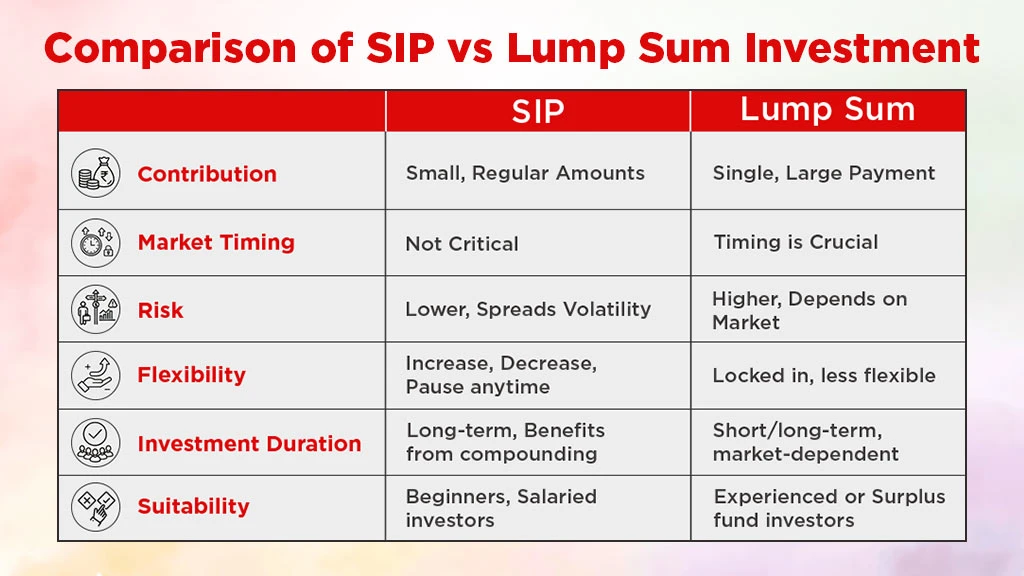

SIP vs Lump Sum: Key Differences

|

Aspect |

SIP |

Lump Sum |

|

Contribution |

Regular and small amounts need to be invested at fixed intervals |

A single and large payment is done at once |

|

Market Timing |

Not dependent on market timing, as investments average out over time |

Accurate market evaluation is very important for the best returns |

|

Risk |

Small investments make it less risky and protect the investment from a volatile market |

High risk and fluctuations in return from day one, but returns can also be higher |

|

Flexibility |

Highly flexible investment where installment amounts can be increased or decreased and even be paused in between installments. |

The investment amount is locked, so not much scope for any kind of changes |

|

Investment Duration |

Best suited for long-term financial goals and to reap the benefits of compounding |

Used for both short- and long-term investment, but depends on market conditions |

|

Suitability |

Best choice for salaried employees and beginners |

Those with extra income or fund investors |

Why Choose SIP?

Salaried individuals or new investors who want long-term and safer investment options can go for a SIP. It doesn’t require a large amount of investment and the market’s sudden changes can have a major effect on a SIP, but if the investment is for the long term, then risks related to short-term market volatility are reduced.

A SIP helps develop a savings habit with time without financial strain, and it is helpful while planning retirement or buying a home. SIP is perfect for investors who want to avoid complex market analysis and simply keep going with their regular SIP contributions.

Why Choose Lump Sum?

Lump sum investment comes with its own risks, but it can be a good option for individuals who can read the market trends or are experienced investors. A fixed amount is put in the market, and higher returns are gained if the market is undervalued and the investment is made at this point.

The whole investment amount here is exposed to market fluctuations, so it becomes very important to have a solid financial plan to reap the benefits. A lump sum investment is most appropriate for people with large amounts of money who can tolerate high risk.

Choosing between SIP investment and lumpsum investment depends on the individual financial goals, risk tolerance, and market conditions. Both investment methods have different, distinct benefits and drawbacks. So, it becomes important to regularly review the investment to keep track of the returns and market conditions.

Frequently Asked Questions On SIP vs Lump Sum Investment

1. What is the difference between SIP and lump sum investment?

In SIP, there is an investment of a fixed amount at regular intervals. On the other hand, in a lump sum investment, a large sum of money is invested all at once.

2. Can an investor stop or pause a SIP investment if needed?

Yes, a SIP investment can be stopped or paused when needed.

3. Is it possible to invest in both SIP and lump sum of the same mutual fund scheme?

Yes, most mutual funds allow investors to start a SIP and invest a lump sum in the same mutual fund plan or scheme.

4. Does market timing affect a lump sum investment?

Yes, market timing affects a lump sum investment. Investing when the market is low can maximize returns, and when the market goes up, it can lead to losses.

5. Which is better SIP or lump sum investment?

There’s no fixed answer when it comes to choosing between SIP and lumpsum investing. The ideal choice depends on financial condition, market condition, and risk-taking capabilities.

Related Blogs