The Rise of Digital Loans in India: Transforming Finance and Agriculture

A digital loan is similar to traditional loans; however, its application, approval, and disbursal are carried out through digital channels. The boom of the digital lending sector in India is due to various factors, including rising digital penetration and a large young population. Its key benefits include quick disbursal, more convenience, and better accessibility. Read on to learn more about how digital loans are transforming the agricultural sector of India by providing quick funds to farmers to cover their farming expenses, including seeds, fertilizers, and harvesting.

Table of Contents

- What is Digital Lending?

- What Fuelled India’s Digital Lending Boom?

- How Does Digital Lending Work?

- What is the Difference between Traditional Lending & Digital Lending?

- What are the Benefits of Digital Lending?

- What are the Challenges related to Digital Lending?

- How Digital Loans are Transforming the Indian Agricultural Sector?

- Key Takeaways

What is Digital Lending?

Digital lending is a financial service that offers loans and credit services through digital channels such as websites or mobile software applications. It uses digital technologies to simplify the lending process, from loan application to disbursal. Even the repayment of a digital loan can be done online. Lenders like TVS Credit specialize in digital lending, offering a wide range of loan products, including two-wheeler loans, used car loans, and tractor loans.

The digital loan process offers flexibility and convenience, which is why it is gaining popularity among the younger, technologically proficient generation. The lending process is quick as it eliminates time-consuming, traditional procedures like extensive paperwork. Also, the rise of the smartphone era has catapulted the growth of digital lending.

What Fuelled India’s Digital Lending Boom?

In the recent decade, India has been at the forefront of digitalization. With huge developments in digital infrastructure, people have started to adopt digital methods across industries. It has also led to the modernization of the traditional lending system. The Indian fintech industry has embraced data and technology for financial services to make the lending system online and efficient.

The growth of digital lending in India can be attributed to several factors, including a large young population, a rise in digital penetration, and per capita income. In 2022, India stood first in digital payments with 74 billion UPI transactions. There are more than 667 million smartphone users and 759 million active Internet users in India. Also, internet penetration was driven by the cheapest-ever data plans. All these factors led to the boom of digital lending in India.

How Does Digital Lending Work?

The digital lending process is quick and straightforward, unlike traditional loans. Customers can easily apply for loans through online platforms like websites and mobile apps. Submission of required documents is also online. After applying for a loan, they can also check the status of the application on the platform.

The creditworthiness of the borrower is checked using several factors, like employment, income, and CIBIL score. Risk check and loan amount are evaluated with the help of data analytics and algorithms. After loan application processing, KYC documentation, and risk check, loan approval is granted. Based on the loan amount, funds are disbursed within a few hours or days. Most of the steps in the lending process are automated for accuracy and time savings. The borrower can repay, foreclose, or take another loan directly from the online platform.

What is the Difference between Traditional Lending & Digital Lending?

Check out the following table for a comparison between digital and traditional lending:

|

Criteria |

Digital Lending |

Traditional lending |

|

Application |

The application process is online, thus fast and convenient. |

Requires personal visits and manual paperwork, thus time-consuming and less convenient. |

|

Risk Assessment |

Fast and accurate. Uses credit scores and modern technologies like Big Data, AI, and ML. |

Risk of error/fraud and slow. Traditional process based on income statements and credit scores. |

|

Disbursal |

Quick loan disbursal within hours or a few days due to a streamlined process. |

Takes a longer time to process the application manually, ranging from a few weeks to months. |

|

Interest Rate |

Generally lower due to lower overhead expenses. |

Typically higher because of higher overhead expenses. |

|

Repayment |

Offer customized or flexible repayment options. |

Lacks repayment options and comes with strict terms. |

|

Loan Amount |

Loan amount can be smaller or customizable. |

Loan amount is usually higher. |

|

Collateral |

Unsecured loans may be offered. |

Usually demands high collateral or security against loans. |

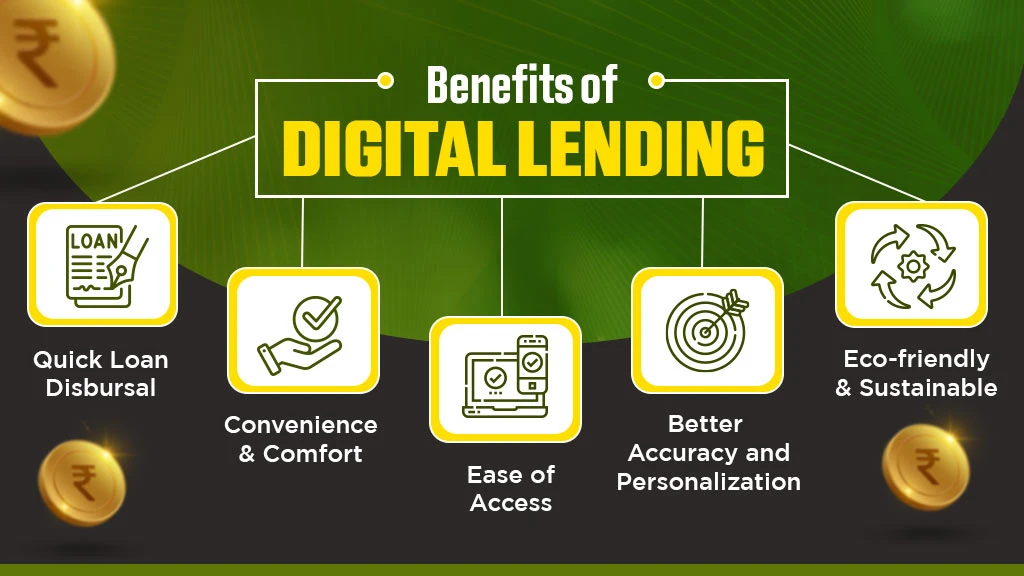

What are the Benefits of Digital Lending?

- Quick Loan Disbursal: The application process is streamlined, fast, and convenient. Also, the approval and disbursal take less time, and borrowers get funds quickly. It is highly beneficial for those who need funds urgently. The decision-making time is shorter, and thus, customers are satisfied with the overall experience.

- Convenience & Comfort: Customers do not need to visit banks or other institutions personally. Also, there is no hassle of in-person conversations with loan officers or agents. Loans can be availed anytime online, comfortably from home. Also, millennials and Gen-Z prefer a smartphone for most tasks as it saves time and provides easy access to lending materials.

- Ease of Access: Digital lending is accessible to a wide range of users. Anyone with a smartphone can apply for funds online. Thus, it favours people who lack easy access to traditional lending services. Also, first-time borrowers without a credit history find it easy to get a loan through digital means.

- Better Accuracy & Personalization: Digital lending makes use of data analytics and advanced algorithms for risk assessment. It is not only fast but also highly accurate. Manual paperwork and investigation are prone to human error and fraud. The use of modern tools offers precise calculation and assessment. Also, it reduces the chances of favouritism or discrimination across the lending process.

- Eco-friendly & Sustainable: There is less dependence on physical paperwork with digital lending. Even documents can be signed electronically with the help of e-signing. Thus, there is no paper wastage, making digital loans a sustainable and environmentally friendly approach. Also, it helps reduce the carbon footprint, which remains a major global issue.

What are the Challenges related to Digital Lending?

- Cybersecurity Risks: With the rise in digital transactions in India, the risk of cyber fraud has also increased. There is a major risk of data breach and financial fraud for customers. Thus, following all security guidelines outlined by the government and lenders is highly important. In addition, lenders need to place strict security measures on their digital platforms so that borrowers do not lose their money or personal information.

- Financial Literacy: A major population of India does not have adequate financial knowledge about digital lending. They are most prone to online fraud. Rural borrowers, including farmers, need to become somewhat familiar with financial concepts and digital solutions. Also, lenders are responsible for educating them about the processes and risks related to digital lending.

- Regulatory Compliance: As the digital lending sector is relatively new, it is evolving at a rapid pace. Thus, scammers may find a loophole in the already established legal framework for digital loans to swindle money from borrowers. The rules and regulations need to be updated regularly to be clear and comprehensive. Lenders also must comply with these codes and guidelines to ensure a safe lending environment.

- Tough Competition: Digital lending still faces tough competition from traditional lending institutions and lenders in mass markets. The rural population hesitates to get involved in digital loans for several reasons, such as a lack of trust and education. Digital lenders need to spread awareness and build trust to grow in such a competitive landscape.

How Digital Loans are Transforming the Indian Agricultural Sector?

- Digitalization of the agriculture sector in India is transforming the lives of farmers. It includes using cutting-edge digital technologies to boost farm production and offering digital credit to help farmers.

- Digital loans are easy to disburse, even to farmers belonging to remote locations where banking facilities are limited.

- Lenders can also easily verify farmers' creditworthiness to release funds quickly, helping them secure funds before planting season.

- Most farmers need loans to buy tractors for their farms at an attractive interest rate. Also, it offers different repayment options on EMIs for their convenience.

- Digital loans offer key benefits to farmers, including faster processing, less paperwork, and quicker funds.

Key Takeaways

Digitalization of the agriculture sector in India is happening at a fast pace. Along with the adoption of cutting-edge digital technologies to boost farm production, it includes providing digital credit to help farmers. Digital loans are easy to disburse, even to farmers belonging to remote locations where banking facilities are limited. Lenders can also easily verify their creditworthiness to release funds quickly. It helps farmers get funds in time before the planting season.

Mostly, farmers take out loans to buy tractors for their farms. A tractor is a highly important piece of farm machinery that increases productivity. A tractor loan allows farmers to buy a tractor at an attractive interest rate. Also, it offers flexible repayment options on EMIs for convenience. Digital loans play a crucial role in the lives of farmers as they provide faster processing, less paperwork, and quick access to new loans.

Related Blogs