Health Insurance in India: What Covers & What Doesn’t?

We all know that one serious illness can wipe out your lifetime savings. Medical expenses in India have become increasingly high. That is why purchasing a health insurance plan is so important. It helps protect individuals' money during medical emergencies. However, there are various factors that contribute to health insurance in India. Thus, let's discuss the importance of health insurance plans in India, types of plans, their benefits, and how they give you financial security.

Table of Contents

- What is Health Insurance, Importance/Need of Health Insurance?

- How Health Insurance Works?

- Types of Health Insurance Policies in India

- Key Benefits of Health Insurance

- What are The Tax Benefits of a Health Insurance Policy?

- What’s Covered and Not Covered in Most Health Insurance Policies?

- How To Choose the Right Health Insurance Policy?

- How to Claim on a Health Insurance Policy?

What is Health Insurance, Importance/Need of Health Insurance?

A health insurance policy in India is a contract between the insurance company and the policyholder (insured person). In this policy, the insurer will pay all the medical costs due to hospitalisations or injuries according to the policy terms in return for payment termed as a premium. To keep the policy active, you need to pay a premium, and in return, the insurance company will cover your medical expenses whenever required.

Health insurance basically serves as a financial fortification so that the cost of healthcare does not turn into a liability. Overall, health insurance is very important to purchase, as it ensures you get proper medical treatment when needed.

How Health Insurance Works?

Understanding how health insurance policy works in India helps you make an informed decision. Here is a simplified overview of a health insurance plan:

Premiums

The premium in a health insurance plan is the amount you pay to keep the policy active. However, the premium amount is not the same for everyone; it’s determined by several factors, such as:

- Age

- Medical history

- Plan type

- Sum assured

- Add-ons or riders

- Lifestyle factors

Coverage

Health insurance coverage in India refers to the extent of financial security your policy provides. Health insurance plans typically cover:

- Hospitalisation costs

- Pre and post-hospitalisation costs

- Ambulance charges

- Critical illness, depending on your policy

- Daycare procedures

- Domiciliary care

- Periodic health check-ups

Network Hospital

An insurance company has special deals with some hospitals, which are commonly known as network hospitals. In a cashless claim, your insurance company will pay all the bills directly to the hospital. You only need to inform the company ahead of the medical procedure. However, in a non-network hospital, you can opt for your treatment and file for reimbursement claims later.

Claim Process

The most essential part of understanding how a health insurance policy works is the claim procedure. To do so, you need to submit a claim form along with some documents. Once your claim is approved by the company, the insurance provider will pay you for the amount covered under your policy. There are two types of claims:

- Cashless claims: If you are admitted to the network hospital, share your health card, and the insurance company pays your bills directly.

- Reimbursement claim: You pay for treatment, submit all the bills, and then the insurer refunds the amount according to your policy guidelines.

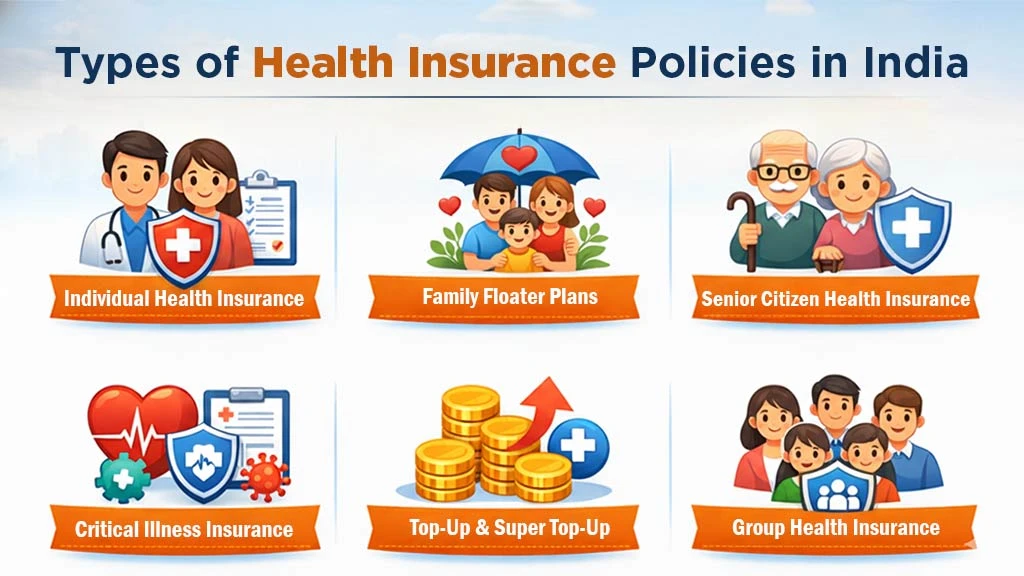

Types of Health Insurance Policies in India

Health insurance plans in India are available for people of all ages, budgets, and health needs. Some of the common types of health insurance plans in India include:

Individual health insurance

An individual can purchase personal health insurance. You pay the premium directly to the insurance company, and you get benefits when you need them. In this manner, you can choose a plan that precisely suits your requirements. If you have no dependents or want exclusive coverage, this plan is ideal for you.

Family floater plans

The family floater is a plan of health insurance for entire family, which comes under a single policy. It generally includes children, spouses, and parents, permitting them to use the coverage when required. The premium of this plan is often more economical than individual policies for each member.

Senior citizen health insurance

This plan is specifically for individuals aged 60 and above. This plan provides higher coverage that ensures older persons receive the healthcare they need without relying on family funds. However, the premiums for this plan are higher than those of other plans due to the higher risk.

Critical illness insurance

This plan covers serious illnesses such as cancer, heart attack, and more. This plan offers a lump-sum payment upon diagnosis of a critical illness.

Top-up and super top-up

The top-up and super top-up plans supplement existing health insurance by covering costs beyond a specified deductible limit. A top-up plan is ideal for those seeking coverage for higher amounts, as it activates once medical expenses exceed the set limit. On the other side, the super top-up plans cover cumulative expenses over multiple claims.

Group health insurance

This plan is provided by employers to their employees. This offers basic coverage at a lower premium than individual plans. It is offered to employees to help them meet the financial crisis and enables them to enrol without medical tests.

Key Benefits of Health Insurance

Health insurance policies offer various benefits that strengthen your financial planning and well-being. Here are some of the top benefits:

Financial protection from medical emergencies: By purchasing a health insurance plan, you can handle the high cost of medical emergencies. Also, it prevents depletion of savings and provides you with peace of mind.

Cashless hospitalisation: With a health insurance plan, you can avail of cashless hospitalisation. You don’t have to pay the bill. The insurance company in which you purchased the health insurance policy can pay the hospital directly. However, this is available only at the network hospital.

Save your taxes: Health insurance also comes with a tax benefit under Section 80D. You can get a tax deduction on the premiums you pay. These tax benefits are prevailing laws subject to change.

No claim bonus: If you don’t make any claim during a health insurance policy year, you will get a policy reward, known as a no-claim bonus. This increases the coverage amount you get without raising your policy premiums.

Extensive medical coverage for modern treatments: Health insurance plans cover hospitalisation, surgery, diagnostics, ambulance service, and more. This enables policyholders to take advantage of modern treatments, which ensure the best possible care is received in cases of intricate health requirements.

What are The Tax Benefits of a Health Insurance Policy?

Health insurance is a powerful tool for tax savings. Section 80D of the Income Tax Act allows policyholders to claim a tax deduction for the premium paid towards a health insurance policy. The deduction is only available for individual taxpayers and HUFs.

You can claim ₹25,000 per year for premiums paid for yourself, your children, and your spouse. Also, this deduction limit extends to ₹50,000 for senior citizens (above 60 years of age). Here is a detailed breakdown of the tax benefit 80D limit in FY 2026:

|

Covered members |

Deduction limit (₹) |

|

Self & family |

25,000 |

|

Self & family + parents (all of them below 60 years) |

50,000 |

|

Self & family (below 60 years) + parents (above 60 years) |

75,000 |

|

Self & family + parents (above 60 years) |

1,00,000 |

What’s Covered and Not Covered in Most Health Insurance Policies?

Health insurance plans in India come with certain inclusions and exclusions. Hence, it's important to check the policy guidelines before purchasing. Let's delve into some common health insurance coverage in India, along with some exclusions that you need to be aware of:

What is covered in the health insurance?

- Hospitalisation expenses, including nursing charges, room charges, medicines, and more.

- Pre- and post-hospitalisation costs, covering expenses incurred before admission and after discharge.

- Domiciliary hospitalisation, if the patient is not able to be moved to a hospital due to severe illness.

- Delivery and newborn care are provided in certain health insurance policies.

- The expenses incurred for transportation by ambulance service from one hospital to another are covered.

- Health insurance plans also cover daycare treatment, where you do not need to be admitted to the hospital for a full day.

- Health insurance plans cover the cost of Ayurveda, Unani, and homeopathy treatments, subject to the policy terms and conditions.

What is not covered in the health insurance?

- Waiting period clause: Health insurance policies in India come with a waiting period clause, in which all plans have an initial waiting period of 30 days. During this waiting period, your insurance company will not accept claims except for accidental claims.

- Pre-existing diseases: You cannot get covered for any pre-existing disease you were diagnosed with before buying a policy. All medical insurance policies cover pre-existing diseases after a waiting period of up to three years.

- Pregnancy/childbirth: Medical expenses incurred due to pregnancy, such as delivery charges, miscarriage, etc., are not covered under the health insurance plan.

- Dental treatments: Dental treatments are not payable as these are short procedures and do not require hospitalisation.

- OPD treatments: Most medical insurance plans do not cover OPD expenses, including the diagnostic test, the cost of doctor consultations, and medicines.

- Cosmetic/plastic surgeries: Plastic surgeries and cosmetic surgeries are not payable by health insurance companies unless they result from an accident.

- Self-inflicted injuries: Hospitalisation due to self-inflicted injury, like suicide or a suicide attempt, is not covered under the health insurance plans.

- Substance abuse treatments: The treatment cost of diseases from excess consumption or addiction to alcohol or drugs is excluded from health insurance plans.

How To Choose the Right Health Insurance Policy?

There are various policies of health insurance to choose from. Hence, it's important to select the best one. Here are the following factors you need to consider before choosing a policy:

- Evaluate your healthcare requirements: Before choosing the policy, think about your age, family medical history, lifestyle, and existing health conditions.

- Opt for an adequate sum assured: Select a sum assured that matches your family's healthcare needs and family size.

- Search for the right coverage: You must choose a health insurance plan that protects you against a wide range of medical issues. Also, consider your needs, and compare different plans on costs and benefits.

- Choose plans with network hospitals: Check whether your preferred hospitals are included in your policy network hospital list or not. Always choose an insurance provider that offers a wide range of network hospitals.

- Look for a high claim settlement ratio: The claim settlement ratio (CSR) of an insurance company shows the total claims settled in a year. Thus, go for an insurance company that has a high CSR so that you have a high chance of getting your claim settled.

- Choose riders based on family needs: Add-ons or riders can enhance the coverage of the health insurance plan. You can consider add-ons such as critical illness cover, personal accident cover, and more. However, by adding these riders, you have to pay additional premiums.

How to Claim on a Health Insurance Policy?

In a health insurance policy in India, there are mainly two types of claims: cashless and reimbursement. Take a look at both claim processes below:

Cashless Health Insurance Claim Settlement

Step 1: Firstly, contact the insurance helpdesk at your network hospital.

Step 2: After that, show your health card issued by your insurance company.

Step 3: The hospital will verify your identity.

Step 4: Next, fill out the pre-authorization form and then submit it at the insurance desk.

Step 5: The network hospital will submit your form to your health insurance provider. Once your insurance company reviews and approves your cashless claim, it will pay the claim amount directly to the hospital.

Reimbursement Health Insurance Claim Settlement

Step 1: Connect with your health insurance provider and inform them about your hospitalisation at the earliest.

Step 2: Obtain treatment and, during discharge, pay all the bills and collect all your documents.

Step 3: Submit the claim form along with documents to your health insurance company.

Step 4: The insurance company will review your documents and process the claim as per the health insurance policy terms and conditions.

Step 5: Once your claim is approved by the insurance company, you will receive the claim amount in your bank account.

Frequently Asked Questions On Health Insurance in India: What Covers & What Doesn’t?

1. What are the different types of health insurance policies in India?

India offers diverse health insurance policies such as individual, critical illness, family floater, group health insurance, and more.

2. What is the ideal age to buy a health insurance plan?

The ideal age to buy a health insurance plan is as early as possible, generally in your 20s.

3. What is the purpose of a health insurance policy?

The primary purpose is to protect you financially from high medical expenses. It covers hospitalisation and other healthcare expenses, ensuring you get timely medical care without any hassle.

4. Are NRIs eligible for the Mediclaim tax benefit?

Yes, NRIs can avail the Mediclaim tax benefit under section 80D of the Income Tax Act.

5. Can I get a health insurance tax benefit?

Yes, individuals and anyone belonging to HUFs can get the health insurance tax benefit.

6. Which illness is not covered under the health insurance policy in India?

Pre-existing diseases, epilepsy, and external congenital diseases are some of the illnesses that are not covered under the health insurance policy.

Related Blogs