Direct Benefit Transfer Scheme: Transforming the Delivery of Services to Farmers

Direct Benefit Transfer (DBT) Scheme, started in January 2013, aims to reform the way government services are delivered to the citizens, including farmers, through better targeting of the beneficiaries and plugging the subsidy leakages by using modern Information Communication Technology (ICT). In this blog, let us understand the DBT scheme, its coverage, current status and the way forward with a focus on agriculture & farmer welfare schemes.

Table of Contents

- Introduction

- What is Direct Benefit Transfer Scheme

- Aims of Direct Benefit Transfer Scheme

- Enablers of Direct Benefit Transfer Scheme

- Agriculture Schemes Under DBT Scheme

- Pre-requisites for Farmers to Avail Benefits under DBT Scheme

- Status of DBT Scheme in 2024-25

- Way Forward

Introduction

Farmers welfare is one of the prime objectives of the government. To this end, the governments – the Centre and the State – have been giving subsidies to farmers for purchasing quality seeds, irrigation, fertilisers, farm equipment, crop insurance, power, etc.

As per the 15th Finance Commission report, the farm subsidies in India constitute 2 – 2.5% of GDP but are plagued by leakages due to inefficiencies in the delivery of services. To address it, the Government of India in 2013 introduced the Direct Benefit Transfer (DBT) Scheme. Today, the DBT scheme covers 314 Schemes of 54 Ministries, including 17 schemes of the Agriculture Ministry.

What is Direct Benefit Transfer Scheme?

Direct Benefit Transfer (DBT) Scheme is a Central Sector Scheme that seeks to directly transfer the subsidies and benefits into the Aadhar-seeded bank accounts of farmers in the form of cash or kind. The scheme builds on the philosophy of MAXIMUM GOVERNANCE and MINIMUM GOVERNMENT.

The scheme entails the use of modern ICT for identification & better targeting of beneficiaries and timely delivery of benefits to the farmers. In the process it seeks to speed up the payments, remove subsidy leakages and enhance financial inclusion.

DBT Scheme was launched on 1 January 2013 by making the first payment to a mother in Puducherry under the Janani Suraksha Yojana.

What is the Aim of Direct Benefit Transfer Scheme?

The DBT Scheme aims to bring a paradigmatic shift in the process of delivering services & benefits to all those who are eligible through

- Accurate identification and targeting of intended beneficiaries;

- Timely delivery of payments to the beneficiaries;

- Curbing duplication and pilferation;

- Promotion of financial inclusion;

- Electronic transfer of benefits and minimising levels involved in benefit flow;

- Setting up accessible, scalable and reliable digital platforms and providing user-friendly interfaces between the beneficiaries and the government;

- Bring efficiency & effectiveness and transparency & accountability in the government processes and infuse confidence of citizens in the governance.

What are the Enablers of Direct Benefit Transfer Scheme?

To successfully implement the DBT Scheme in a diverse country like India, there are certain critical success factors, and these are:

JAM Trinity

JAM (Jan Dhan Account, Aadhar and Mobile) trinity is a new-age solution that uses technology as an enabler for financial inclusion. It enables the successful transfer of benefits to targeted beneficiaries in a leakage-proof, cashless and timely manner under the DBT Scheme.

Business Correspondents (BC)

BC is an authorised representative who offers services such as cash transactions in areas where bank branches do not exist. The creation of BC or Bank Mitras infrastructure and strengthening it will ensure the timely delivery of payments in full value to the beneficiaries at their doorstep.

Payments Bank

A Payments Bank, like any other bank, can accept deposits and enable the transfer of payments through mobile phones but on a small scale. Moreover, it cannot advance loans or issue credit cards. The introduction of the Payments Bank in 2015 by RBI aimed at deepening the penetration of financial services in a secure manner to the remote areas of the country.

Mobile Money

To ensure that each underprivileged person has access to the DBT scheme, the mobile money for cashless transactions using Aadhar as an identifier can be helpful in furthering last-mile connectivity.

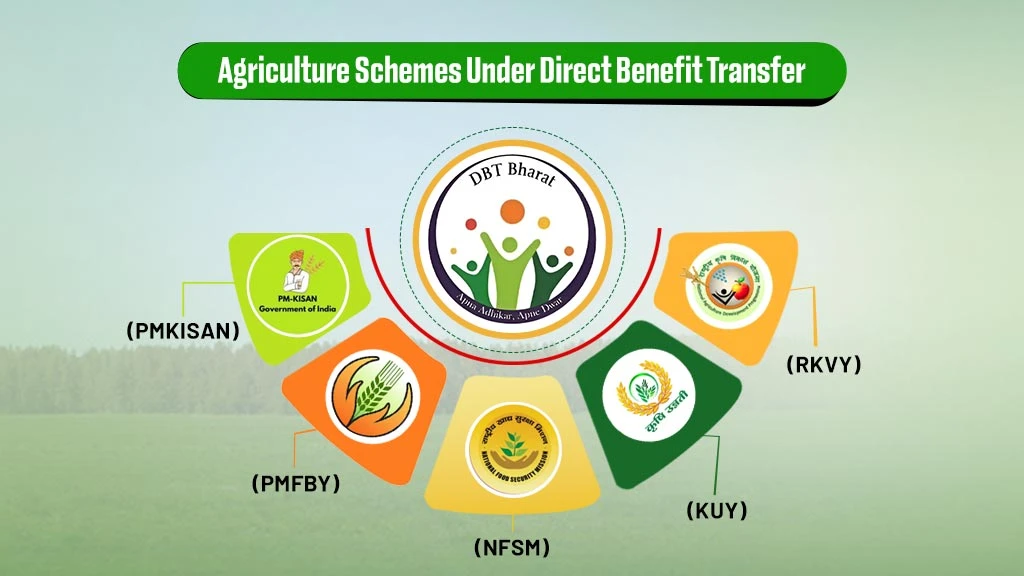

What Agriculture Schemes Come Under DBT Scheme?

Under the DBT Scheme, 17 agricultural schemes have covered and some of the important schemes are:

- Sub Mission on Agriculture Mechanisation (SMAM)

- Mission for Integrated Development of Horticulture (MIDH)

- Pradhan Mantri Kisan Samman Nidhi (PM KISAN)

- Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Krishi Unnati Yojana (KUY)

- National Food Security Mission (NFSM)

- National Mission on Edible Oil-Oil Palm (NMEOOP)

- Per Drop More Crop (PDMC)

- Rashtriya Krishi Vikas Yojana (RKVY)

- Sub Mission on Seeds and Planting Material (SEEDS)

- National Livestock Mission

- Livestock Health and Diseases Control

- Pradhan Mantri Matsya Sampada Yojana

What are the Pre-Requisites for Farmers to Avail Benefits under DBT Scheme?

- Aadhar Card: Ensure that you have the 12-digit Aadhar number readily available with you.

- Mobile Number: A valid mobile number linked to your Aadhar card.

- Bank Account: An operational bank account or Jan Dhan account linked to your Aadhar and mobile number.

In addition to the above necessary documents, any other documents as required under a specific scheme covered under the DBT scheme.

What is the Status of Direct Benefit Transfer Scheme in 2024-25?

Since the introduction of the DBT Scheme in 2013, the cumulative direct benefit transfer amounts to INR 39, 66,478 crores. The below table provides the data for the financial year 2024-25.

|

Total direct benefit transfers |

INR 2,90,705 crore |

|

Total number of transactions |

315 crores |

|

Total number of schemes covered |

314 |

|

Total number of Ministries |

54 |

|

Estimated Gains |

INR 3,48, 565 crores |

What is the Way Forward?

DBT Scheme has revolutionised the drive for financial inclusion in India by re-engineering and reforming the complex processes of service delivery to the citizens, including farmers. It has ensured timely and better delivery of benefits and helped stop subsidy leakages benefiting the exchequer and people at large. However, some issues still exist, such as the need for a universal beneficiary database & grievance redressal system, ensuring DBT payments through the Aadhar Payment Bridge (APB) and rationalising government subsidies.

Related Blogs