Understanding PPF or EPF vs NPS for long-term gains

In the daily rush for our career growth and earnings, we often forget to pause and plan our financial future. Yet, early retirement planning is the most brilliant move one can make. In the same vein, when we contemplate having an independent financial future, we often feel intimidated by the multiple investment products available. Today, in this blog, we will explore EPF, PPF, and NPS, comparing them based on risk, returns, and taxation.

Table of Contents

- Are We Forgetting Retirement?

- Understanding EPF, PPF and NPS

- Compare EPF, PPF, and NPS

- Making the Choice

Are We Forgetting Retirement?

The question is worth asking, as in today's world, we are planning everything in our lives, from small weekend outings to our next job switch.

However, when it comes to taking time to plan our retirement, we often find ourselves stuck in the race and give ourselves the excuse of being too occupied. But the reality is that early retirement planning is not an act of fear but an act of wisdom that provides you with financial security for the future.

We often assume that everything is running smoothly, from our careers to our businesses, but we must acknowledge the fact that life is full of uncertainty. We never know whether unexpected responsibilities may deplete our savings. Thus, it is our responsibility to plan ahead and live our retirement with dignity.

Now, the good part is, we don't have to be finance experts to plan our retirement, as the government eases the way for us by offering long-term savings schemes like the Employees' Provident Fund, Public Provident Fund, and the National Pension System. These schemes can help you build your retirement corpus. Let's understand this in depth.

Understanding EPF, PPF, and NPS

When it comes to post-retirement financial security planning, three government-backed schemes-EPF, PPF, and NPS-top the list. However, these schemes differ slightly in terms of functionality and beneficiaries.

Let us understand these differences below and build our understanding.

Employees Provident Fund

EPF is a safe investment option for salaried employees in organized sectors, helping them build a financial cushion over time. Employees contribute 12% of their basic salary plus DA, matched by the employer, and the fund grows with compound interest. It also offers liquidity on retirement or under certain conditions and provides tax benefits, as both contributions and interest earned are tax-free.

Below mentioned are the key features:

- Eligibility: It is mandatory for all the salaried employees who are employed in an organisation with a strength of more than 20 employees.

- Contribution: Under this scheme, 12% of basic salary + DA is contributed by the employee and an equal amount is contributed by the employer as well.

- Interest Rate: 8.25% interest per annum for FY 2024–25.

- Tax Status: Under Exempt-Exempt-Exempt- contribution amount, interest earned, and the maturity amount are all exempted from income tax till the limit of INR 2.5 lakh per year.

- Liquidity: In this scheme, partial withdrawals can be found under specific conditions such as medical reasons or housing.

Public Provident Fund

The scheme is ideal for those who prefer minimal risk, as it is a safe long-term investment option. It has a fixed 15-year tenure and a government-backed interest rate of 7-8% (revised quarterly). Its biggest advantage is the tax benefit: investments under Section 80C, in which the interest earned and the maturity amount are all fully tax-free, making it a reliable choice for retirement planning.

- Eligibility: The scheme is open for all Indian residents, and it is best suited for self-employed individuals.

- Contribution: One can make an annual deposit of INR 500 to INR 1.5 lakh.

- Interest Rate: For FY 2026-26, 7.1% per year is applicable.

- Tax Status: It follows the exempt-exempt model, thus your invested amount, interest earned and amount after maturity are all tax-free under section 80C.

- Liquidity: Under the scheme, liquidity can be found restricted. However, partial withdrawals are available after the completion of 5 years.

- Lock-in-Period: It has a strict 15-year lock-in period.

National Pension System

The National Pension System (NPS) is a government-backed, retirement-focused scheme that brings flexibility in investment and provides you with the potential for higher returns as it is market-linked. You can also enjoy attractive tax benefits and take help from the scheme to build a long-term corpus for retirement. All this makes it ideal for those who want to take moderate risks and achieve better returns.

- Eligibility: It is open to all Indian citizens falling in the age bracket of 18 to 70.

- Contribution: In this scheme, investments are made across equity, corporate debt and government securities.

- Interest Rate: As NPS is market linked thus interest are market driven wigth an estimated return of 9-12 %.

- Tax Status: The contributions made are tax deductible, then your returns will grow tax-free and on maturity, 60% of the corpus is tax-free and the remaining portion is taxable.

- Liquidity: Highly restricted; withdrawals are permitted only under specific conditions, and a portion must compulsorily be used to purchase an annuity at age 60

Compare EPF, PPF, and NPS

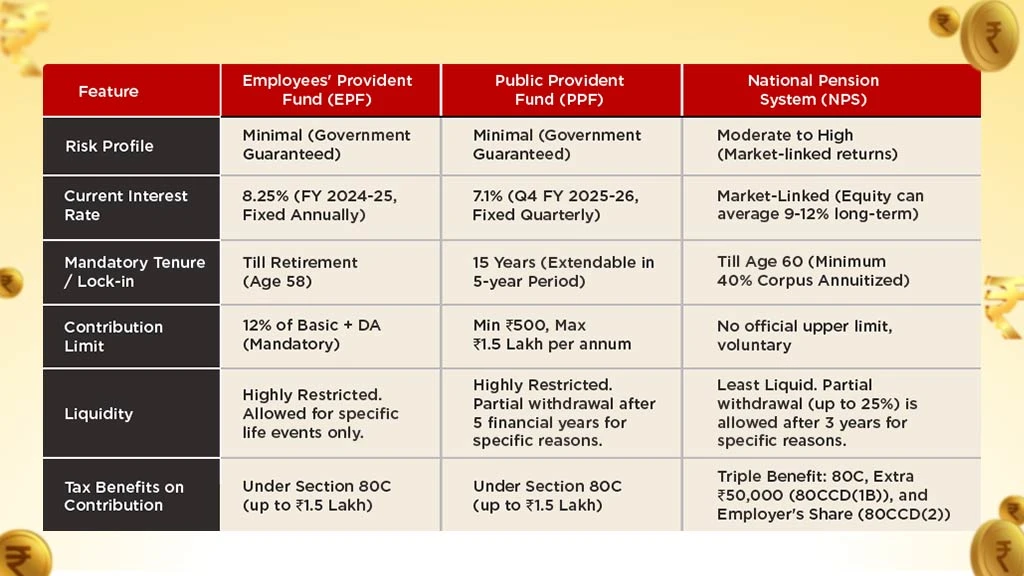

You can refer to the image below for a simplified comparison of EPF, PPF and NPS.

Make a Choice

EPF can be found as the ideal choice for those who are prioritising maximum tax-free safety and are comfortable with compulsory savings. However, when it comes to PPF, it fits best for those who are self-employed or for those seeking a second retirement account and value EEE tax status. Lastly, NPS is best for young professionals who have a high-risk appetite and seek higher returns through equity with an additional INR 50,000 tax deduction.

Frequently Asked Questions On Understanding PPF or EPF vs NPS for long-term gains

1. NPS vs PPF: Which one is a better option for investing?

NPS and PPF both are best in their own way, where one provides you with flexibility of investment choice and the other comes with low risk.

2. Is NPS better than EPF for tax benefits?

NPS offers an additional tax deduction under Section 80CCD(1B), whereas EPF contributions are entirely tax-free at maturity.

3. What are the disadvantages of NPS?

There are certain limitations of NPS funds, such as limited liquidity before retirement and partial taxability of withdrawals.

4. How can I get a ₹50,000 monthly pension under NPS?

You need a corpus of roughly Rs. 1 to 1.2 crore at retirement, assuming an annuity rate of 5-7%. However, the annuity rate changes over time; thus, the exact pension amount can vary.

5. NPS vs PPF – Which one is a better investment option?

NPS and PPF are both better options. However, NPS is suitable for long-term wealth creation, while PPF is good for safety, guaranteed returns, and liquidity.

Related Blogs